Case of the Day: Macroeconomics and Happiness

Can you buy happiness?

The old adage says no: "Money can't buy happiness." Indeed, we have all known people whose material circumstances make them the envy of others, yet they are never satisfied with what they have and always seem unhappy. Yet others seem constantly full of joy despite material hardships that none of us would choose.

So are people simply unhappy (or happy) regardless of their material situation? Would the fortunate but unhappy people be even unhappier if they were poor? Would the happy pauper be truly ecstatic if made wealthy? Or can becoming rich actually make someone less happy?

Or does the causality work in the other direction? Are people who are chronically dissatisfied with their lot in life motivated to become rich while those who are happy with meager means choose not to pursue greater wealth?

Psychologists and behavioral economists have begun exploring connections between economic variables (at both the macro and micro level) and happiness. A number of consistent results have emerged from these studies, which we will examine below. But first we consider the assumptions of classical economics and what these assumptions mean for macroeconomics and happiness.

Macroeconomic variables and happiness: Theory

Classical microeconomics rests on the assumption that individuals have well-defined preferences and choose the pattern of goods consumption and labor supply that maximizes their utility, subject to their budget constraint. If the limitation imposed by a consumer's budget constraint is relaxed somewhat, then she will have more income and will be able to consume more goods. The additional consumption allows her to move to a higher indifference curve and a higher level of utility. It seems as though she should/must be happier at the higher level of income than at the lower level.

The argument above left labor/leisure out of the equation, but including it really doesn't change much. When we consider her decision between labor and leisure, income becomes an endogenous choice: the consumer can choose a higher or lower income by choosing to work more or less. In this case, the exogenous variable that drives her budget constraint is her real wage rate: the amount of additional goods and services that she can obtain by working one additional hour.

An increase in the real wage rate rotates her budget constraint outward, allowing her to reach a higher indifference curve and achieve greater utility. Some of the utility gain from an increase in the hourly wage rate might be taken in leisure rather than income/consumption. (Recall that the income and substitution effects conflict, which allows the labor-supply curve to slope upward or bend backward.) However, it is still the case that individuals with high real wages tend to have high incomes (even if they work slightly less) and should be able to attain higher utility than they would if they had lower real wages.

Macroeconomic analysis places a lot of emphasis on aggregate variables such as real gross domestic product (GDP), the unemployment rate, and the inflation rate. Real GDP (or its close relative real national income) attempts to measure the total income of everyone in an economy, adjusted for inflation so that it measures real purchasing power.

So, do increases in aggregate real GDP mean that everyone in the economy earns higher utility? Not even the most jaded macroeconomist would claim this. For example, if the government mandated that everyone had to work 80 hours per week, real GDP would undoubtedly rise, but most people would have lower utility. (We know this because most workers could work additional hours if they wanted to, but choose not to do so.) Or, to take a different kind of example, the rise in real GDP could be accompanied by a change in the distribution of income that left some people much better off but others worse off even though the change in average income was positive.

However, if real GDP increases without an increase in hours worked, then someone in the economy must have higher income than before. And if there is no change in the general pattern of income distribution in the economy, then it might be reasonable to assume that many or most people in the economy have seen their budget constraints shift outward. If their budget constraints have shifted outward, then they can achieve higher utility and it seems like they should be happier. This is the basis for using real per-capita GDP as an indicator of economic well-being. It is easy to construct cases where it works poorly, but if everything else stays the same it's probably a decent broad indicator.

Another key variables of macroeconomics is the unemployment rate. The unemployment rate measures the share of the labor force that is not working but is actively looking for work. Although there are many measurement problems with the unemployment rate, it attempts to measure the share that is out of work not by choice but involuntarily. Being involuntarily unemployed means that you are unable to choose the leisure/goods position that you prefer. It may be reasonable to assume that those seeking work would have higher utility if they were to become employed. Thus, a higher unemployment rate would mean more people suffering lowered utility because they are constrained away from the optimal leisure/good point they could achieve if they found work. Thus, to the extent that it truly reflects involuntary unemployment, a higher unemployment rate might be associated with lower utility for those affected. (We must be careful with this argument, however, because some degree of unemployment is inevitable and desirable if we are to achieve an optimal matching of heterogeneous workers and jobs. An inventory of searching/unemployed workers and vacant jobs is the cost society must pay for efficient allocation of heterogeneous labor in a world of imperfect information.)

The relationship between inflation—another key macroeconomic variable—and happiness is even more tenuous than those of GDP and unemployment. We will study the costs of inflation and learn that these costs depend in important ways on considerations such as whether or not the inflation was correctly anticipated by people in making economic arrangements and setting prices and wages.

Macroeconomic variables and happiness: Evidence

Should a government rely on such variables as real GDP and the unemployment rate as goals of macroeconomic policy? Most of them do, but the tiny nation of Bhutan thinks it has a better idea. The article from the New York Times linked below describes an effort by the King of Bhutan to base his economic policies around measures of happiness rather than GDP.

A recent survey of the evidence on economic happiness is Bruno S. Frey's book Happiness: A Revolution in Economics, MIT Press, 2008. Much of the discussion below is based on this book.

The most common way of measuring happiness is simply to ask people in surveys to assess how happy they are on a numerical scale. This method is open to a variety of criticisms, including whether people will respond truthfully (economists usually prefer to rely on observing actual behavior such as purchases rather than asking people questions) and whether the answers of respondents who are very different from each other will be comparable. Nonetheless, if we are careful to remember the limitations of the data, we can get some interesting information from such surveys.

Income and happiness

Frey breaks down the question of how income affects happiness into three sub-questions:

- "Are people with high income at a given point in time happier than those with low income?

- "Does an increase in income over time increase happiness?

- "Are people in rich countries happier than those in poor countries?" (p. 27)

The answer to the first question appears to be yes, which is reassuring for utility-based economic theories. In surveys within countries, rich people are on average significantly happier than poorer people. However, there is evidence that happiness is more strongly affected by "relative" income than by its absolute level. People who are richer (poorer) than those they perceive to be their peers tend to be happy (unhappy) regardless of their absolute living standard. Similarly, happiness is closely related to the degree to which one has achieved his or her income aspirations.

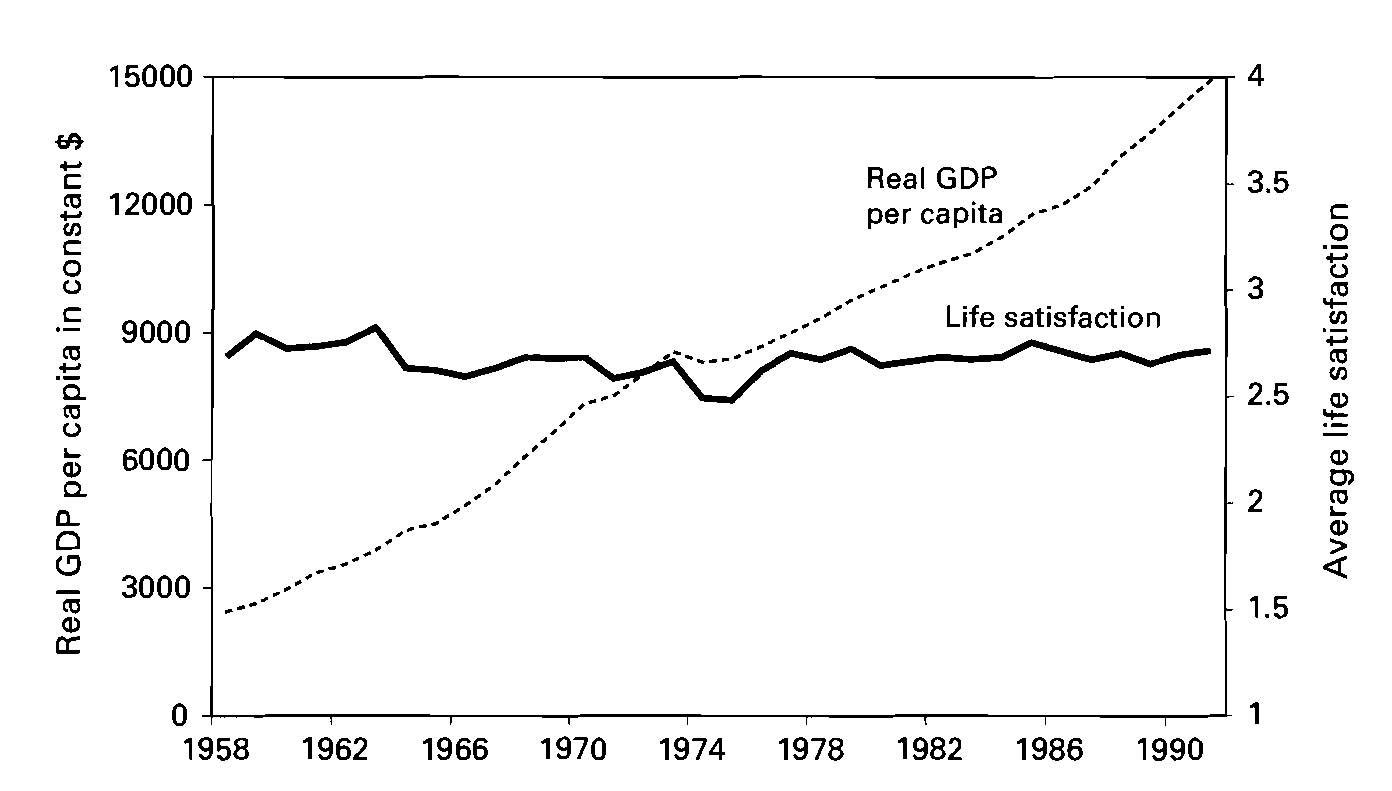

The second question is more of a puzzle. Although incomes have grown dramatically in most of the world, people's survey responses suggest that they are not getting happier. Frey's Figure 3.1, reproduced below, shows this relationship for Japan.

The most common explanation of this paradox is that as per-capita income grows over time, people's aspirations rise, so it takes more income to make them think that they are happy. Under this explanation, an increase in income raises happiness initially, but once people get used to their new, higher standard of living, they come to expect it and it no longer raises their survey responses. If this explanation is correct, then high income does raise happiness in the sense that if you took people from 1990 and lowered their living standards back to 1960 levels then they would be unhappier, and if you took someone from 1960 and raises his or her living standard to the 1990 level they would be happier. However, the society as a whole does not report that it is getting happier over time as incomes rise.

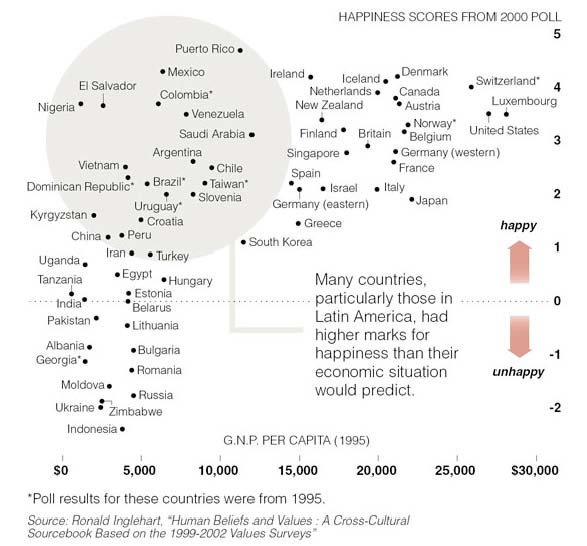

The third question is also somewhat puzzling. Although higher-income countries usually report higher levels of happiness, the relationship is not clear-cut. The figure below is from the New York Times article cited above (it may not have been included in your downloaded version). Although the relationship is clearly upward-sloping, there are many relatively poor countries that seem to be happier than GDP would predict.

The aspiration mechanism discussed above might help explain these results as well. People in richer countries have higher income expectations and aspirations, so it takes a higher income level to satisfy them.

Unemployment and happiness

Surveys consistently show that people who are unemployed are much less happy than those who are working. Longer spells of unemployment have greater effects on happiness. These effects seems to be particularly strong among men, especially middle-aged men. Economists have surmised that this is because in Western societies it is traditionally more acceptable for young and old men and for women to be out of work, where men in their "prime working years" are expected to be working.

In addition to the direct effect of unemployment on those who are actually unemployed, there is some evidence that a higher aggregate unemployment rate makes everyone less happy. This may be due to worries about losing jobs or it may be empathy for the unemployed.

Inflation and happiness

While economists have doubts about the ill effects of a moderate and well-anticipated inflation, such experiences seem to make the public rather unhappy. Casually, this was reflected in the "misery index" devised in the 1970s, which simply added the unemployment rate and the inflation rate to get an indicator of how unhappy voters were likely to be with macroeconomic conditions. Survey evidence suggests that an appropriately calculated misery index should give inflation less weight than unemployment. (Frey reports that a 1.7 percentage point increase in inflation reduces happiness about as much as a 1 percentage point increase in unemployment.) However, the substantial impact of inflation on people's self-reported happiness suggests that it is an important macroeconomic variable.

Inequality and happiness

A final macroeconomic variable that one might expect to affect happiness is inequality of the income distribution. The survey results (see Frey, section 5.2) offer interesting evidence on this question. In the analysis of inequality and happiness, it is important to control for the happiness effects of one's own individual income, so that we do not mistakenly attribute a poor person's unhappiness to inequality when in fact it is simply due to his poverty.

In European countries, greater inequality seems to lead to lower happiness for the poor, even taking the unhappiness associated with their own poverty into account. The happiness of Europe's rich is not strongly affected by inequality. In the United States, inequality has no effect of its own on happiness for either rich or poor. When one breaks out the results by self-described political affiliation and wealth, it is only the rich, left-wingers who are made unhappy by inequality. Poor left-wingers, poor right-wingers, and rich right-wingers are unaffected.

Questions for analysis

1. Given the evidence discussed above, do you think that the U.S. government should pursue policies that: (a) promote real GDP growth in the long run, (b) ameliorate recessionary losses in GDP, (c) decrease unemployment in recessions, (d) lower inflation, (e) promote greater income equality?

2. How confident are you about the reliability of the results of a survey asking people to self-report their happiness? What are the factors that lead you to be confident or skeptical?

3. Choose one or two people that you know well who might have been asked by the survey to rate their happiness (yourself, your parents, or someone else). How well do you think that their responses would have conformed to the general survey evidence presented above? Does knowing their situations lead you to any theories (either discussed above or different) about the connection between economic variables and happiness? Explain.