Case of the Day: Monetary and Fiscal Policies in 2008-10

The financial crisis that erupted in the summer and fall of 2008 was a severe challenge to economic policymakers, the more so as it occurred at the end of the Bush Administration's tenure and during a hotly contested presidential campaign in which the incumbent party suffered a severe defeat. In response to the "Great Recession" that accompanied the financial chaos, unprecedented monetary and fiscal policy actions were undertaken by the Federal Reserve System, the Congress, and both the Bush and Obama Administrations.It was fortunate, if not entirely fortuitous, that the Fed and President Obama's Council of Economic Advisers were led by two of the leading scholars of the Great Depression, Ben Bernanke and Christina Romer. Although in Romer's case she was limited by a sometimes-limiting Congress, these two outstanding economists crafted a policy response to a downturn that initially mirrored the early stages of the economic contraction that began in 1929.

A recession begins

Although it quickly blossomed into an economic crisis unseen since the 1930s, the beginnings of the "Great Recession" were much quieter. A useful timeline of the financial crisis is provided by the Federal Reserve Bank of St. Louis. By their reckoning, the first sign of financial difficulties was the announcement in February 2007 by the Federal Home Loan Mortgage Corporation (Freddie Mac) that it would stop buying subprime mortgage-backed securities. For the six months, economic news emerged about the deteriorating condition of financial firms in housing-related markets, but there was no sign of widespread collapse or of macroeconomic weakness.

On August 7. 2007, the Federal Open-Market Committee (FOMC) declined to shift its policy stance toward stimulating the economy, keeping its target federal-funds interest rate at 5.25%. Three days later, after the failure of three investment funds run by France's largest bank, the Fed reassured banks that funds would be available through discount lending should they require additional liquidity. The first reduction in the target runds rate was a large-for-its-time decline to 4.75% in September 2007, which was followed by two further quarter-point reductions, bringing the rate to 4.25% in December 2007. At the same time, to alleviate liquidity concerns at banks, the Fed created a Term Auction Facility (TAF), which allowed banks needing liquidity to borrow from the Fed more or less anonymously, avoiding possible adverse publicity associated with traditional borrowing from the Fed. (Financial markets were very nervous about banks at this point; any bank seen as needing Fed support might be subject to speculative attack in financial markets or even shunned by potential transaction partners if worries about its solvency were severe.) The TAF was the first of several extraordinary mechanisms that the Fed devised to provide credit to troubled sectors of the financial industry.

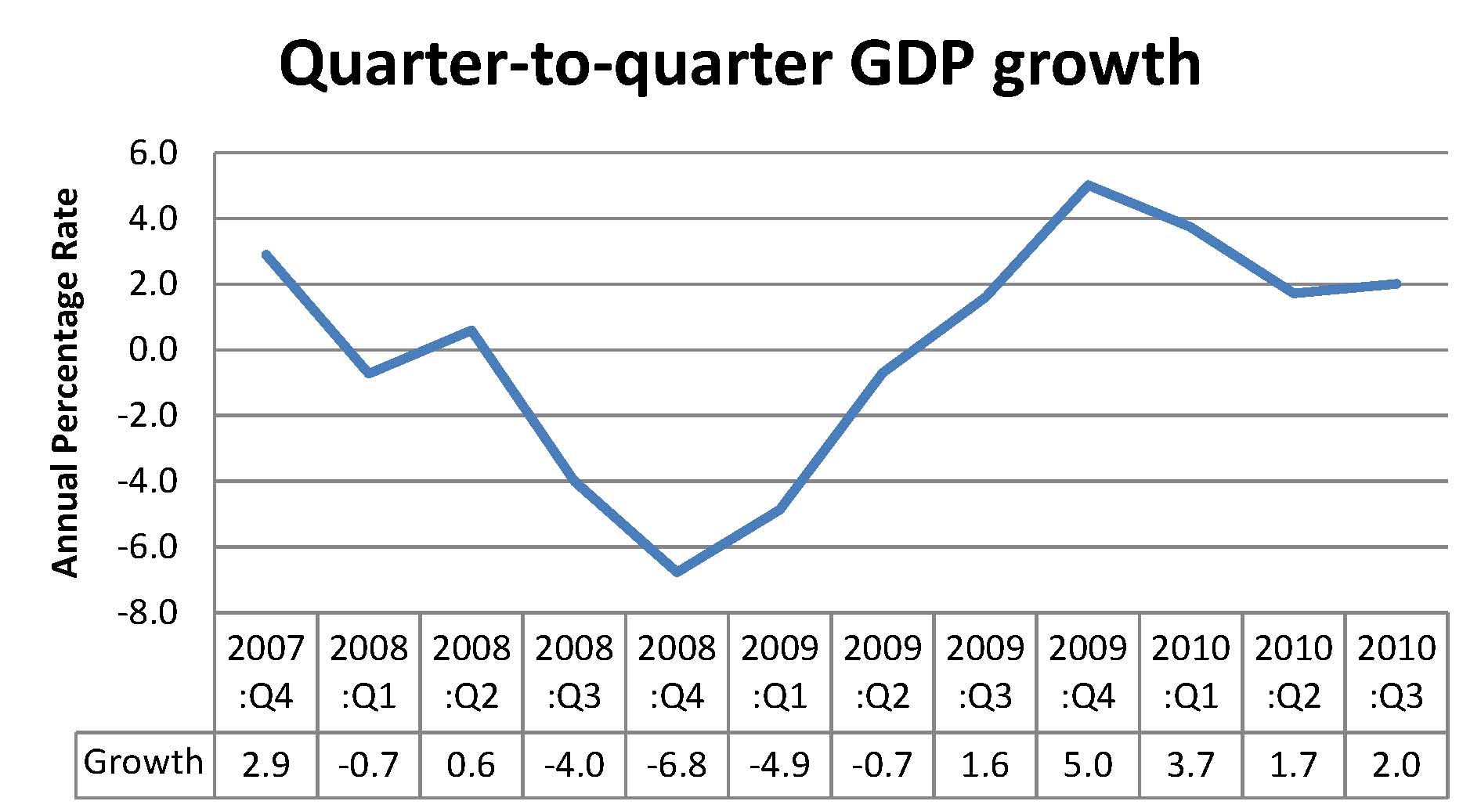

The recession officially began in December of 2007, though (as so often happens) the signs were not apparent until a few months later. Data on GDP for a quarter are first released by the Bureau of Economic Analysis (BEA) about a month after the end of the quarter, but these early releases are based on fragmentary data and are substantially revised over the following months and years. The first release of GDP for the fourth quarter of 2007 were released in February 2008 and showed GDP increasing at a sluggish 0.6% annual rate. (The Federal Reserve Bank of Philadelphia compiles a "real-time" data set showing snapshots of the available data for any quarter "as of" any subsequent month. Many interesting theses could be based on these data!) In was not until August 2008 that data revisions first indicated falling GDP in 2007:Q4 and by that time the BEA was showing slow positive growth in the first two quarters of 2008. Based on the data through the first half of 2008, the economy seemed to be sluggish, but not in any serious difficulty. Indeed, current estimates suggest that the economy actually grew in the fourth quarter of 2007 and that it grew at about a 1% per year rate between October 2007 and June 2008. The major downturn occurred in the third quarter of 2008, as shown in Figure 1 below.

Figure 1

Despite the lack of official GDP data indicating a recession, the Fed had lots of information by early 2008 supporting expansionary policy. Financial markets and the banking system were clearly unsettled and other "leading indicators" of the economy (especially those related to housing markets) seemed to be heading downward. On January 22, just a week before a scheduled FOMC meeting, they decided in an emergency conference call to cut the funds rate from 4.25% all the way to 3.75%, followed by a further cut to 3% at a regular meeting on January 30, 2008.

Although fiscal policy is often slow to react to business cycles, in early February the Democratic Congress passed and President Bush signed the Economic Stimulus Act of 2008. This Act provided tax rebates of $300 - $1200 for low-income and middle-income families. Economic theory suggests that households that have either ample savings or access to credit markets should base consumption spending on their lifetime income rather than just income in the current year. One-time tax rebates such as those of ESA2008 are most likely to be added to savings or used to pay down debt by such consumers, meaning that they will not add much to aggregate demand. Indeed, a survey by Matthew Shapiro and Joel Slemrod found that only about 20% of households planned to "mostly spend" their rebates, with over 30% planning mostly to save it and about half planning mostly to use it to pay off debt. Spending associated with the rebates may have helped GDP grow modestly in the second quarter of 2008, but it is clear from Figure 1 that they at best postponed the large decline that ensued in the last half of the year.

On March 11, 2008, the Fed created another extraordinary credit mechanism, the Term Securities Lending Facility (TSLF), allowing banks to exchange high-grade mortgage-backed securities for more-liquid Treasury bills for up to a month. Within the week, the Fed had extended its help to investment banks and other non-bank financial institutions through the Primary Dealer Credit Facility and lowered the target funds rate to 2.25%. Later in March, the large investment firm Bear Stearns failed and the Fed provided a loan of $29 billion to JPMorgan Chase to allow it to take over Bear Stearns rather than shutting it down.

The economy in steep decline

As Figure 1 shows, the economy entered a free-fall in the second half of 2008, although the grim news was not seen in BEA releases until the February 2009 release initially estimated a 3.8% decline in GDP for the fourth quarter of 2008. The simmering chaos in financial markets boiled over in mid-September 2008, when, in a matter of two days, Merrill Lynch was saved by a takeover by Bank of America, Lehman Brothers filed for bankruptcy protection, and the Fed announced that it was committing up to $85 billion to loans to rescue insurance giant AIG. Any of these three events would have been a financial-market tsunami; together they looked like the end of the world. Washington Mutual failed 10 days later (taken over the JPMorgan Chase) and Wachovia fell (to Wells Fargo) in early October.

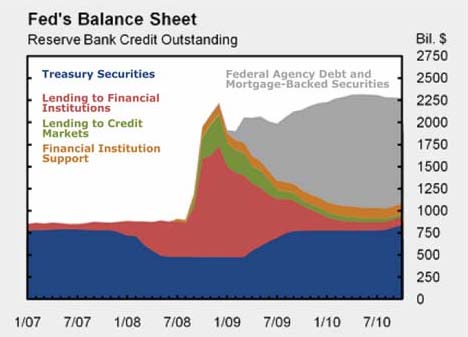

The Federal Reserve during this time was trying to provide credit to the financial sector through an ever-widening array of extraordinary credit mechanisms. In particular, the market for short-term commercial paper, on which large corporations depend for week-to-week funding needs, was largely frozen by fears about which firms and dealers were solvent and which were not. The Commercial Paper Funding Facility was designed to provide liquidity to that market through purchases of private commercial paper. By this time, the Fed had reached far beyond its usual practice of holding only government securities and liabilities of banks, engaging in emergency asset purchases wherever the latest fire might need to be extinguished.

On October 3, 2008, after less than a fortnight of debate, Congress passed and President Bush signed the Emergency Economic Stabilization Act of 2008, which provided up to $700 billion for the Fed to purchase mortgage-backed securities and other assets through the Troubled Asset Relief Program (TARP). TARP funds were subsequently used to acquire shares in AIG to replace the earlier loans, as well as large quantities of mortgage-backed securities that banks and other financial institutions could not get rid of to other buyers. General Motors and Chrysler also eventually received funding through TARP.

During the depth of the crisis in September and October, the issuance of new asset-backed securities had ground to a halt. Unable to securitize loans, banks were beginning to restrict long-term lending through student loans, small-business loans, and mortgages, which put further downward pressure on aggregate demand. To try to encourage lending and re-establish the market for these securities, the Fed created the Term Asset-Backed Securities Loan Facility (TALF) in late November 2008 (although the first loans were made in March 2009), offering $200 billion to buy newly issued high-grade asset-backed securities.

Finally, on December 16, 2008, after a long series of gradual reductions, the Fed dropped the taget federal-funds rate to a range of zero to 0.25%, where it remains almost two years later. With the funds rate at its practical minimum and extensive special lending programs in place, the Fed seemed to have done as much as it could to stimulate the economy.

On the fiscal policy side, the Obama Administration took office in January 2009 with a large majority in both houses of Congress. in mid-February, the American Recover and Reinvestment Act of 2009 because law. The "fiscal stimulus" bill, as it became known, provided about $800 billion in tax cuts and federal spending to stimulate the economy over two to three years. Although it is difficult to assess the impact of such programs, the President's Council of Economic Advisers estimated in January 2010 that "the ARRA added between 2 and 3 percentage points to real GDP growth in the second quarter of 2009; between 3 and 4 percentage points in the third quarter; and between 1½ and 3 percentage points in the fourth quarter." While the Council has a vested interest in showing that its programs have been successful, there was very likely a substantial positive effect.

In mid-March 2009, the FOMC, having no further scope to lower the federal-funds rate, announced a round of "quantitative easing." This involved the purchases of about $1 trillion of securities, both additional mortgage-backed securities and also longer-term Treasury bonds. Conventional wisdom is mixed on whether such monetary expansions can be effective when short-term interest rates are already near zero. A second round of quantitative easing was announced in November 2010, with the purchase of an additional $750 billion of longer-term Treasury securities over the following nine months. the evolution of the Fed's asset holdings is shown in Figure 2, from the Federal Reserve Bank of San Francisco.

Figure 2

Summing up

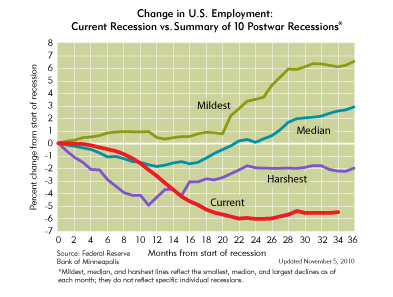

The "Great Recession" that began in December 2007 officially ended in June 2009. However, that just means that real GDP stopped shrinking and the economy hit bottom. So far, the recovery has been weak and employment growth has been especially slow to rebound.

Figure 3, taken from the excellent Recession in Perspective site by the Minneapolis Federal Reserve Bank, compares employment growth in the current recession to the other tem postwar recessions. (I strongly recommend a visit to this site to examine the large collection of very useful diagram like Figure 3.)

Figure 3

Keep in mind that this recession differed from the norm by the fact that the steepest declines in GDP were not at the official starting date but 6-12 months later. Nonetheless, the current recession clearly has had dire effects on employment that are not going away quickly.

In early November, Fed Chairman Ben Bernanke wrote an op-ed article for the Washington Post on "What the Fed Did and Why." In this article, Bernanke points proudly to having helped prevent an even deeper catastrophe, but he also points to the continuing need for policy stimulus going forward. (This article came out a couple of days before the official adoption of the second round of quantitative easing.)

Other useful summaries of the current policy response are the New York Times reference site on the stimulus package (containing details of bill and its passage) and an op-ed piece in the Times by Warren Buffett, thanking the U.S. policy authorities for averting a more serious catastrophe. (These links may require registration at the NYT Web site.)

Questions for analysis

1. During the last half of 2008, the Fed seemed to take "baby steps" in reducing the federal-funds rate target, before finally lowering it to zero. Why can't the Fed push the rate any lower than zero? Why do you think that the Fed was so seemingly reluctant to push the rate all the way to the floor?

2. Once the funds rate was essentially at zero, the Fed embarked on two rounds of quantitative easing. What effects will these large-scale asset purchases have on banks' reserves? If banks have a lot of excess reserves, how will they decide whether to keep them or increase lending? If banks don't increase lending very much, what effect would quantitative easing have on the money supply (currency held by public plus deposits) and on aggregate demand?

3. Critics of quantitative easing have focused on two points: (1) it may be ineffective as noted in the previous question, and (2) if it is effective, then the resulting large monetary expansions will ultimately lead to inflation. What should the Fed do over the coming years to keep inflation from getting out of control?

4. As Christina Romer discussed in her recent talk at Reed, current fiscal policy faces a tightrope between the need for further stimulus and the need to restrain the rapid growth of government debt. Indeed, the report of bipartisan National Commission on Fiscal Responsibility and Reform is to be (or was, depending on when you read this) released on December 1, 2010. Given the constraints of deficit reduction and the need for further stimulus, what advice would you offer the incoming Congress about fiscal policy?